Lydia accounts

Current account, shared account, online money pots, savings account, “envelope” accounts, trading account… You can create and manage any type of account with Lydia.

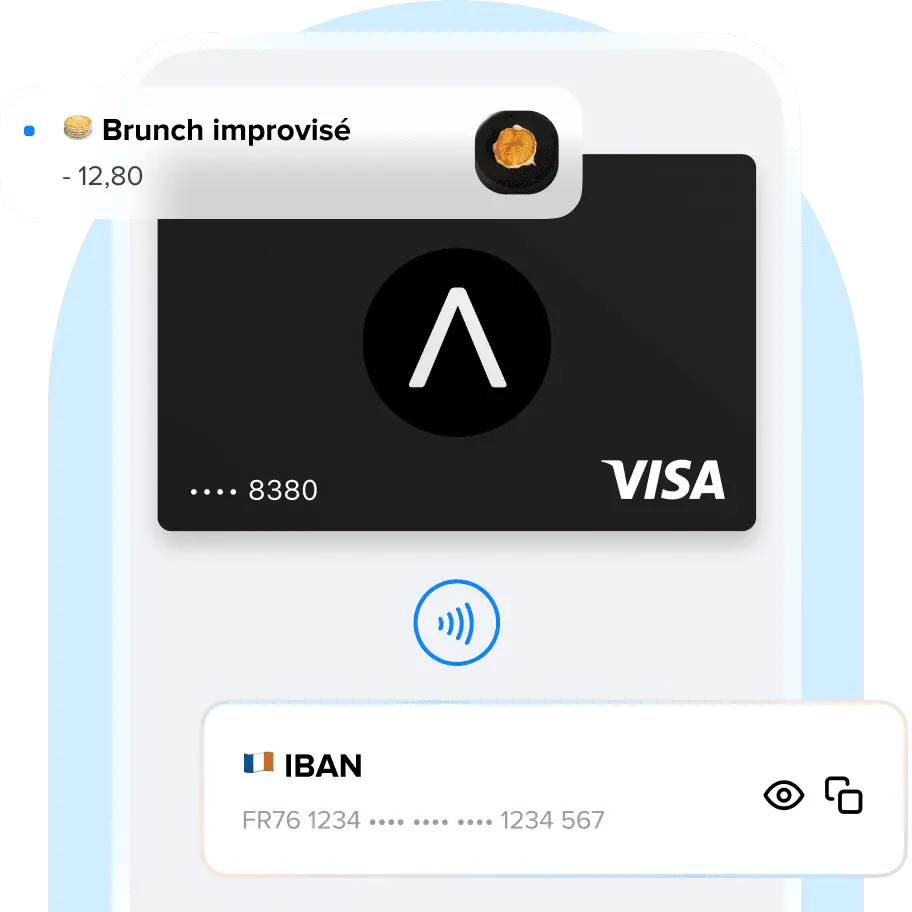

Personal current account

A real mobile account for your day-to-day expenses, which includes:

- A payment card to pay in-store or online, and make ATM withdrawals

- An IBAN to receive salaries and direct debits

- All the features of your typical modern bank account, to manage your money

Shared accounts

An account designed for 2 or more people: couples, flat-shares or holidays with friends.

It works like a classic current account, with an IBAN as well as an optional card to pay for shopping and subscriptions.

Opening a Lydia shared account is done in 2 minutes, right in the application: no paperwork. And you can cancel anytime.

Savings account

A savings account with 2.5% interest per year (boosted to 4% for the first 3 months) and with the money available within 1 day.

And with sub-accounts, like the “envelopes” accounts, store your money and keep better track of it in order to save up.

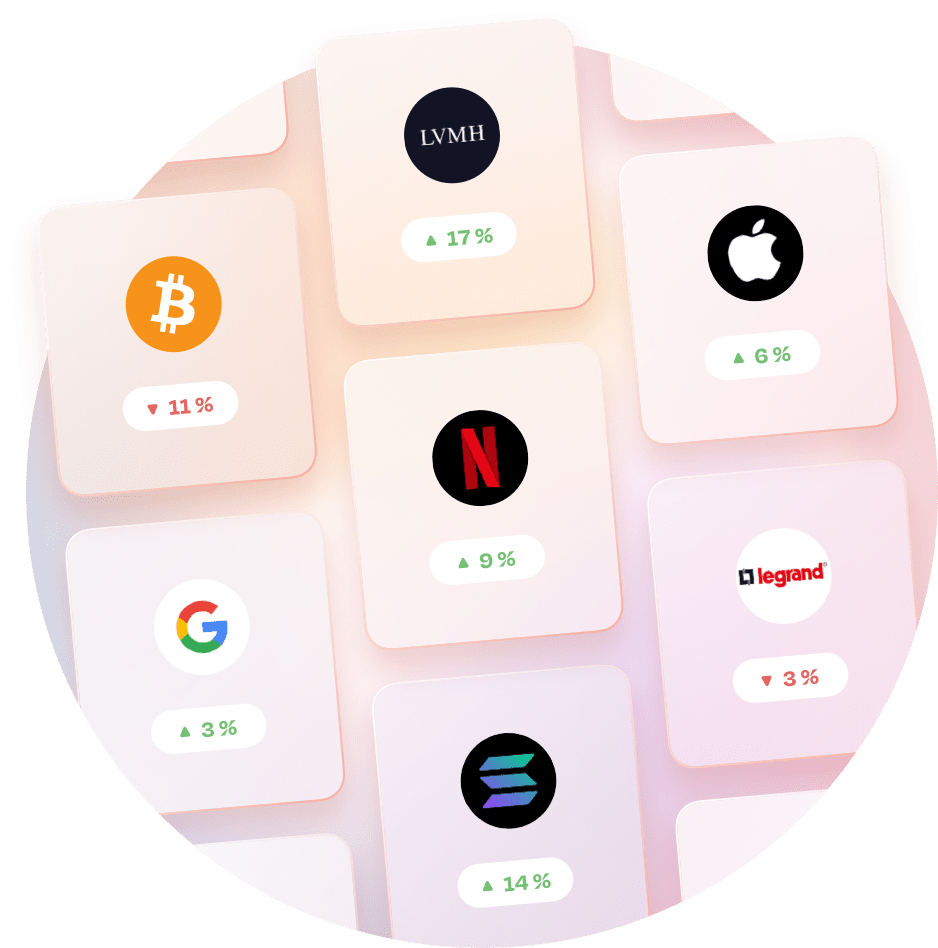

Trading account

An integrated trading platform: invest in more than 2,500 available assets (companies, cryptos, ETFs, metals) with the money on your Lydia accounts.

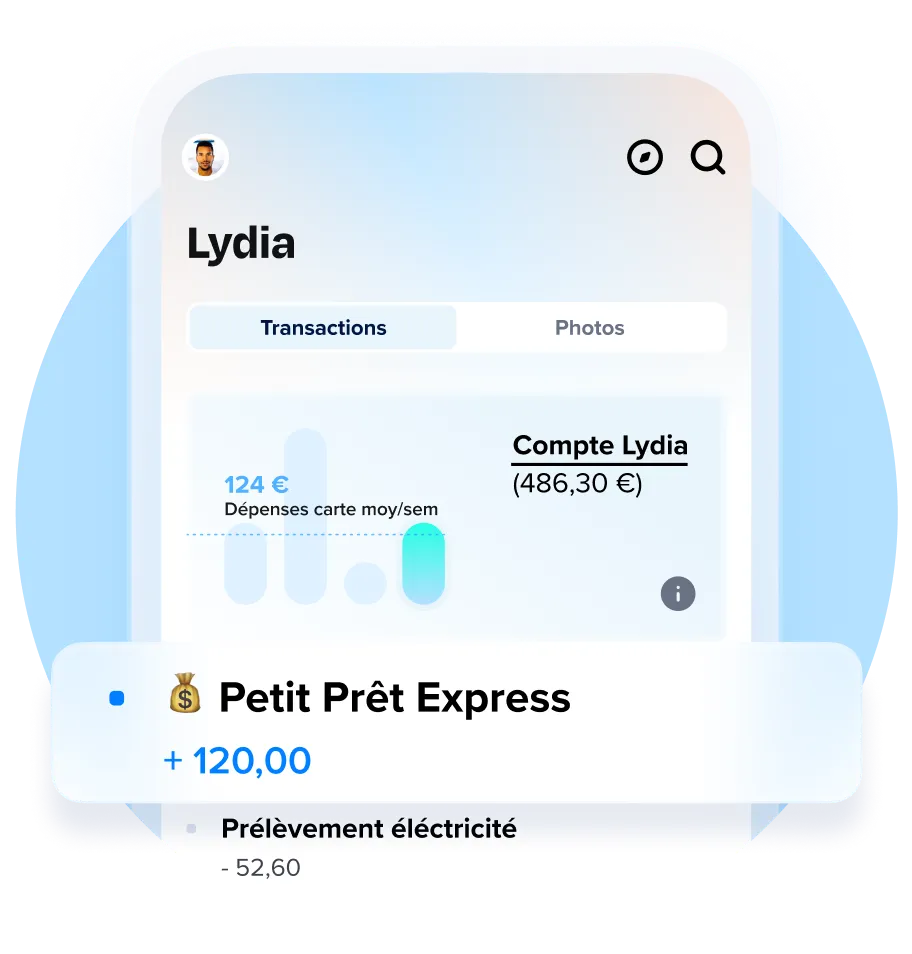

Loans

Loans from €100 to €3,000 with repayment periods up to 36 months, to deal with deal with unexpected expenses or if you don’t want to miss a good deal. Also: no hidden fees.

Envelopes

Secondary accounts for better budget management and savings.

Create an envelope for each budget (groceries, bills, rent, drinks out, etc.) and set how much you want to allocate each month.

Once the envelope is topped up, you can start spending the money without having to worry about going over budget.

Money pots

Online money pots for all your special occasions: a loved one’s birthday, a wedding gift…

Anyone can contribute using the internet link.

The money collected can be used as you wish using the various means of payment available in the app.