Savings

Try Lydia’s savings account: a safe way to grow your savings with a 3% interest rate, boosted to 4% for the first 4 months, right from the Lydia app.

A savings solution for everyone

Lydia’s remunerated savings account is a safe solution that centralizes and protects all your savings.

It’s free and it’s open to everyone, including low-income users.

As far as interest rates are concerned, enjoy a 3% annual rate, boosted to 4% for the first 4 months. No need to leave your money unattended on a current account.

A savings account without constraints

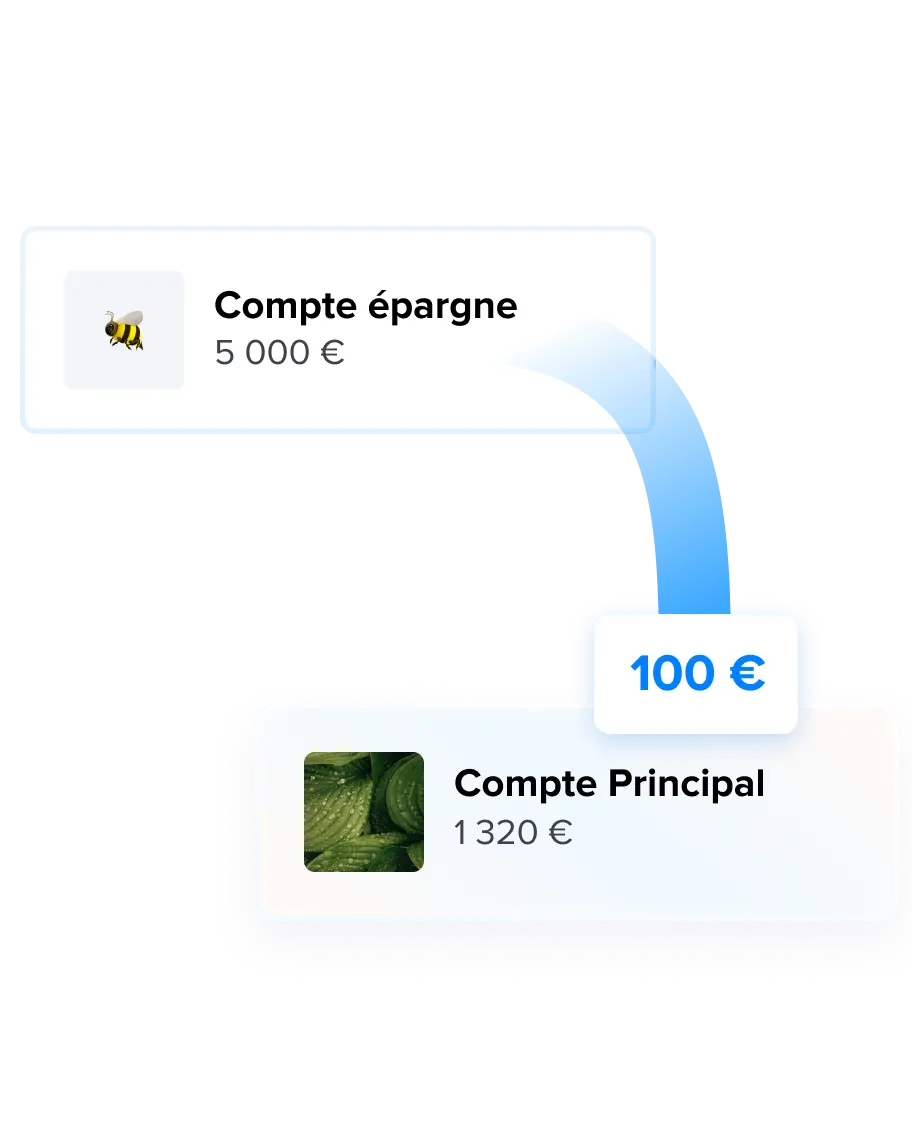

Access your savings at any time with Lydia’s remunerated savings account and use your funds without limit, whenever you want.

You can also program a recurring transfer to put money aside automatically and effortlessly build up your savings.

Open a savings account in 2 minutes

With Lydia’s savings account, you no longer need to see an advisor and sign dozens of pages: open it in 2 minutes, right from the application.

And you can close the account just as easily, whenever you want.

A risk-free savings account

Lydia’s savings account is run by an institution authorized by french authorities.

Enjoy a 3% interest rate, while also keeping your funds safe in a bank that is fully guaranteed by french authorities, even in case of bankruptcy.